Global Solar Market to Hit 85GW in 2017—Double the Amount Installed in 2014

A surge of development China turned the global solar market around, according to GTM’s latest Global Solar Demand Monitor. by Julia Pyper

Record solar demand in China has shifted the outlook on global PV installations for 2017, according to the latest Global Solar Demand Monitor from GTM Research.

Chinese demand exceeded 34 gigawatts last year, pushing global installed solar capacity just over 78 gigawatts. That’s up from the 51 gigawatts of solar installed in 2015, and puts cumulative installed capacity beyond 306 gigawatts worldwide.

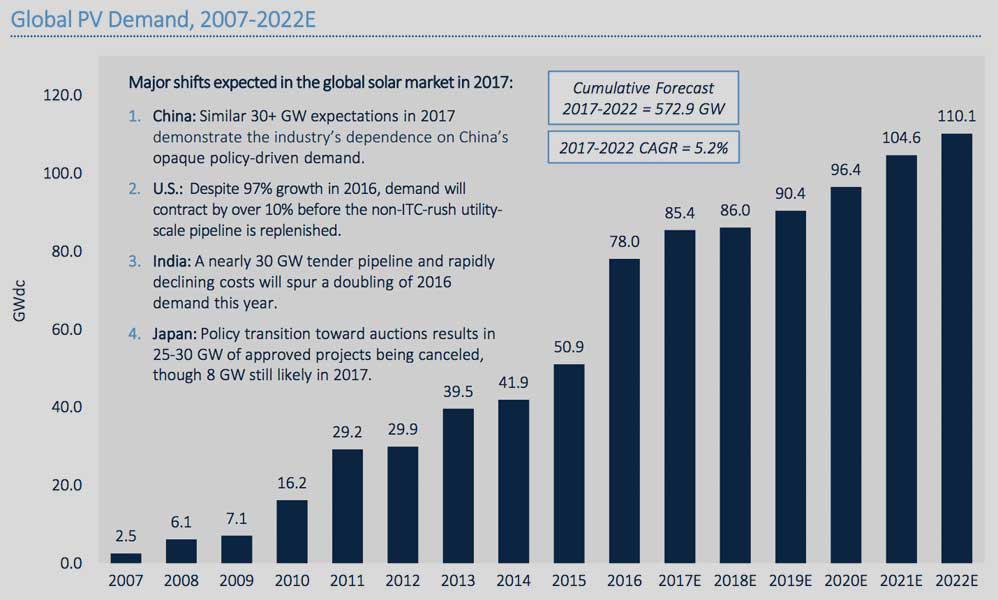

The performance of China’s solar market exceeded analyst expectations last year. It flipped the global demand story from an expected 7 percent global PV market contraction in 2017 to 9.4 percent growth, with a 5.3 percent compound annual growth rate through 2022.

GTM Research currently projects the annual global solar market to reach 85 gigawatts in 2017 — more than double the installed capacity in 2014. The higher forecast is driven largely by China, which is expected to install roughly 30 gigawatts of the 2017 total.

China’s opaque policy landscape

China historically has been a difficult solar market to track because it’s subject to the “unpredictable whims” of the National Energy Administration (NEA), said GTM Research associate Benjamin Attia.

China saw a surge in project deployments in the first half of 2016 (totaling more than 22 gigawatts) ahead of planned cuts to the country’s feed-in tariff (FIT) program. Another round of steep FIT cuts were expected for 2017, but the NEA ultimately issued higher rates.

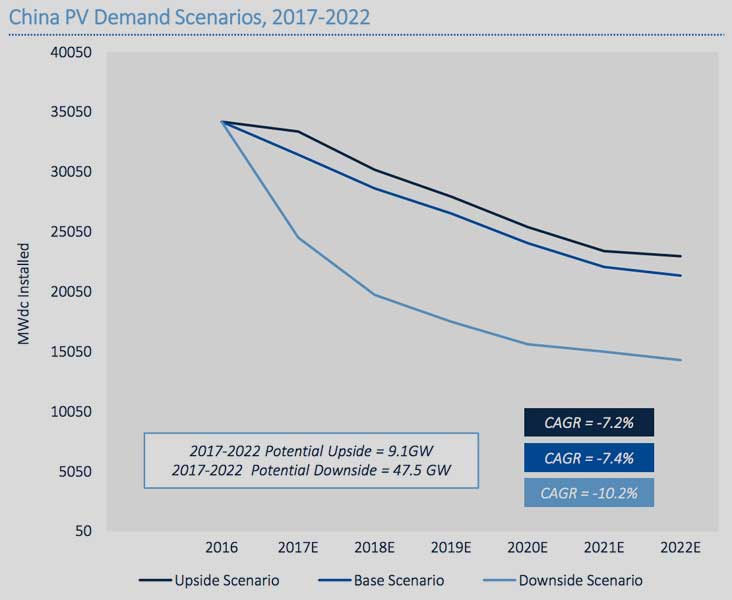

Because of China’s opaque policy environment, GTM sees two possible scenarios for Chinese demand. In the first scenario, FIT cuts continue as demand tapers over time and shifts to smaller market segments. Eventually, the FIT would be replaced with competitive auctions. This is likely to track GTM’s base-case projection for China (shown below).

In the second scenario, the FIT program remains in place through 2017, and then the NEA shifts to competitive reserve auctions in 2018. This change, which sources say is under discussion, would likely be made with the intention of capping solar demand, limiting the curtailment of excess solar generation and addressing the FIT program’s longstanding back-payment issues. Auction volumes would be informed by China’s Five Year Plan amounting to an estimated 15 to 20 gigawatts of annual demand through 2022. This route would likely follow the downside scenario.

What happens in China matters to the entire solar industry because it represents such a large portion of the overall solar market. That means policy uncertainty at the NEA poses a potentially market-destabilizing risk to the entire industry’s supply and demand balance.

“The concentration and unpredictability of demand at a quarterly level, driven by uncertainty in China, can put the market at risk for module price instability and can require idling for suppliers due to overstocked inventory, imperiling the future bankability of the supply chain,” the report states.

Growing project pipelines in emerging markets

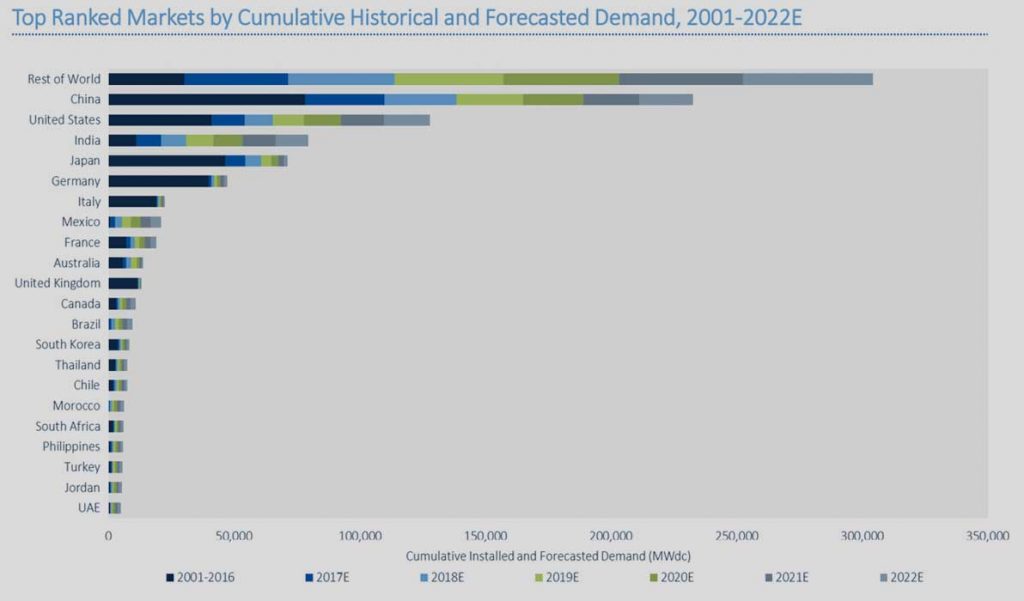

China wasn’t the only country to experience a banner year in solar last year. The U.S. also smashed records, reaching 14.6 gigawatts of solar in 2016. Going forward, the U.S. China, Japan and India will dominate the global market, with an estimated 73 percent of global demand in 2017.

India will overtake Japan as the third-largest global market. At the same time, the German and U.K. markets are expected to slow, while demand shares will increase in Mexico, France, Australia and a number of Middle Eastern markets.

The consolidation of demand share by traditional major markets in China, the United States, India and Japan “is contrasted with a distribution of demand share among emerging markets as tender policies create significant pipelines in markets with little to no historical installations prior to 2016,” according to the report.

“It’s now possible for many countries to procure solar competitively without having a domestic solar market whatsoever,” said Attia.

But it’s unclear “whether that’s sustainable without a domestic industry or regular cadence of [auction] tenders,” he added.

Global solar installations are expected to grow by less than 1 percent from 2017 to 2018. But GTM Research expects the market to take off again in 2019 as tendered projects from earlier years reach their completion, and as new markets begin to take off. Incremental growth over the next five years will depend increasingly on middle-income countries and emerging markets.

How low can they go?

A big part of what’s driving global solar market expansion in new markets is the precipitous decline in solar costs.

In the fourth quarter of 2016 records were set in Sweihan, UAE ($24.2 per megawatt-hour) and Mexico ($26 per megawatt-hour), while intense price competition drove down prices in India. These changes “demonstrate that globally, unsubsidized grid parity has arrived or is fast approaching.”

GTM Research analysts expect a 2-cent per kilowatt-hour PPA to be signed in 2017, potentially in Saudi Arabia, where developers have access to highly attractive financing, virtually free property and lower permitting costs. These types of features could see a record-setting bid signed this year below 2 cents per kilowatt-hour. But super low prices are not expected to be the norm, said Attia.

“We don’t view these ultra-low bids as a long-term sustainable trend,” he said. “We believe only projects that capitalize on scale, preferential non-recourse financing, and free land, permitting costs and long construction timelines can achieve these prices, and their viability as bankable assets is yet to be proven.”

World-leading bid prices are forecast to stabilize in 2018.