Despite COVID-19 market contraction, appropriate stimulus measures can deliver bright global solar forecast

In 2019, the global solar power sector returned to a two-digit growth path, increasing by 13% to 116.9 GW, marking a new annual installation record – Solar expanded its annual share among all other power generation technologies to 48%.

- Despite a potential 4% market contraction in 2020 due to COVID-19, solar is expected to enter the Terawatt age in 2022, only four years after the 0.5 TW level was reached

- In 2019, 16 countries added over 1 GW, in comparison to 11 in 2018, and 9 in 2017

- The top 5 solar markets in 2019 were China with 30.1 GW of new installations, the US with 13.3 GW, India with 8.8 GW, Japan with 7 GW, and Vietnam with 6.5 GW

Today, SolarPower Europe released its new Global Market Outlook, which analyses solar installations in 2019, and forecasts capacity for 2020–2024. The market analysis showed that in 2019, the global solar sector returned to a two-digit growth path, increasing by 13% to 116.9 GW, marking a new annual installation record. This record-breaking growth helped solar expand its annual share among all other power generation technologies to 48%, which means that solar accounted for almost half of the global net power plant capacity installed in 2019.

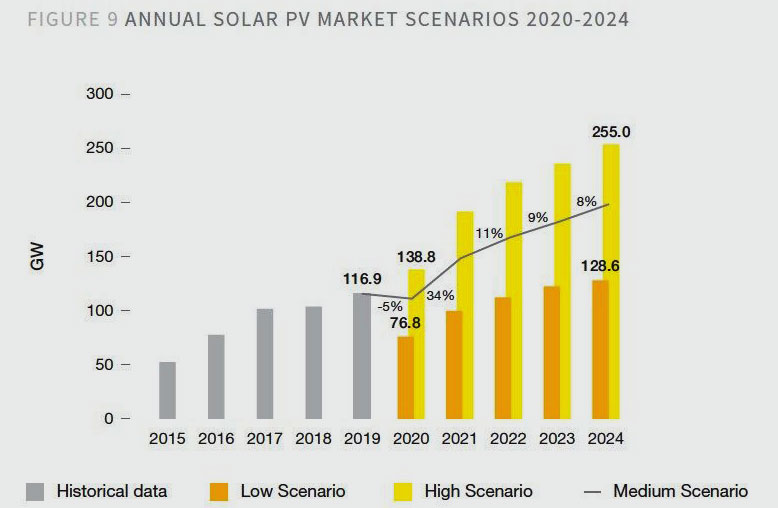

Due to the impact of COVID-19 and the extended lockdown on the global economy, the solar market will experience a contraction in 2020, with an expected decrease of 4% to 112 GW in the Medium Scenario. Compared to last year’s Global Market Outlook forecast which projected 144 GW of new solar, this represents a decrease of 32 GW. This decline is due to reduced demand, and restrictions on labour and supply chain issues. However, if governments opt for sustainable post-COVID economic recovery packages, solar is forecast to undergo strong growth in the next four years, with annual demand to increase by 34% to 150 GW in 2021, 12% to 168 GW in 2022, 9% to 184 GW in 2023, and 9% to 200 GW in 2024.

Aristotelis Chantavas, President of SolarPower Europe, said: “Depending on the priorities of the recovery package, we can return to impressive growth for solar PV over the next five years. This is a favourable time to invest in technologies of the future, which will ensure that we meet the energy and climate targets. Today, solar power is delivering low-cost and reliable energy to millions of households and businesses around the world, and it is imperative that we keep up this momentum as the world slowly recovers from the COVID-19 outbreak, by ensuring solar is acknowledged in stimulus packages.“

Chantavas added: “The low-cost and versatility of solar has accommodated its rapid expansion in new markets which embraced the technology. In 2019, 16 countries added over 1 GW, in comparison to 11 in 2018, and 9 in 2017, showing how the diversification of the solar sector is spreading around the world, and creating new energy and employment opportunities. It is good to see new markets strongly committing to a solar future. For example, Vietnam is emerging as a solar superstar, adding 6.5 GW in 2019, a 6,400% increase from the 97 MW added in 2018. These are very encouraging developments, paving the way for the solar decade ahead of us.”

Gianni Chianetta, Chairman of the Global Solar Council Chairman, added: “As we move out of the acute phase of the COVID-19 emergency, it is imperative to get the PV sector and the entire value chain back on its feet to protect investment, jobs, and businesses. But the pandemic has opened the eyes of many people to the need to put solar power at the heart of green stimulus policies and plans to build back better because of its potential to connect environmental protection and climate action with public health and resilient communities.”

The Global Market Outlook projects solar capacities worldwide to reach the Terawatt scale by 2022, with green recovery measures in place, a mere four years after the 0.5 TW level was reached. Further milestones identified in the report include global solar capacity reaching 700 GW in 2020, 1.2 TW in 2023, and 1.4 GW in 2024, according to the Medium Scenario. However, under optimal conditions, the High Scenario reveals that the global solar capacity could be as large as 1.67 GW by 2024.

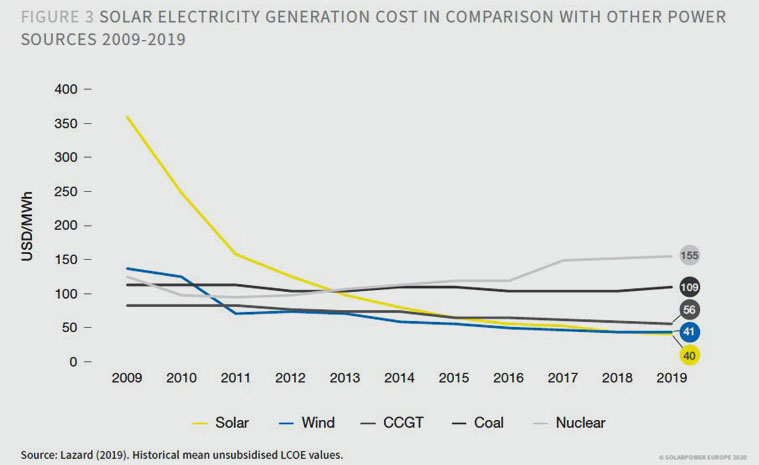

Aurélie Beauvais, interim CEO of SolarPower Europe, said: “It is becoming increasingly clear that solar is not only the most affordable and scalable renewable technology, but is often the lowest cost power generation technology overall. Only one year after several tenders saw solar-winning bids enter the 2 US cent /kWh level, the next frontier was reached in 2019, with solar tariffs in the 1 US cent range achieved in four different regions: Latin America, North America, Europe, Middle East. “

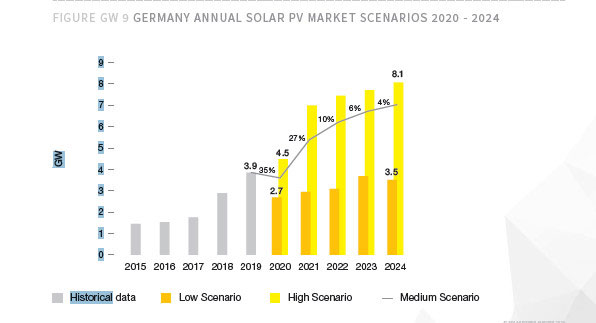

Beauvais added “Europe continues to be a solar leader, adding 22.9 GW of capacity in 2019, more than twice the installations of 2018. Europe’s solar boom in 2019 is thanks to the efforts of many member states: four countries added over 1 GW, with four others getting very close to GW-scale. We must not lose this momentum, with the right policies in place post-COVID that accelerate the European Green Deal, the power of solar can be truly harnessed to usher the EU, and the world, into a new clean energy future.”

Michael Schmela, Executive Advisor and Head of Market Intelligence at SolarPower Europe, commented: “If our High Scenario assumptions could occur, this would result in a global annual market size of up to 255 GW in 2024. But that would be the optimal case, where policymakers in the key markets decide to reap the benefits of solar and place it high on the agenda in their COVID-19 economic recovery packages, which not only would help economies to bounce back; it would also help those countries progress in meeting their energy and climate targets. The low-cost, scalability, and job-richness of solar makes it an obvious contender to lead the energy transition and help guide economies into a climate-neutral era.”

The Global Market Outlook shows that nearly three quarters of the top 20 markets are expected to install at least 10 GW each between 2020 and 2024, according to our Medium Scenario, with new capacity additions anticipated to range from 281 GW in China, to 5.9 GW for Israel, the last on the list. All 20 markets combined are estimated to add a total of 693 GW until 2024.