New study reveals path to reshore solar manufacturing in Europe

SolarPower Europe has published a new study with Fraunhofer Institute for Solar Energy Systems (ISE), revealing that the cost gap between Net-Zero Industry Act-compliant modules and Chinese imported modules can be reduced to below 10% with the right urgent policies.

- The report highlights the risk that, without additional measures, NZIA provisions could support solar supply chain diversification without boosting European solar manufacturers, as there remains a significant cost difference (2.2 to 5.8 €ct/Wp) between NZIA-compliant EU-made and NZIA-compliant non-EU modules.

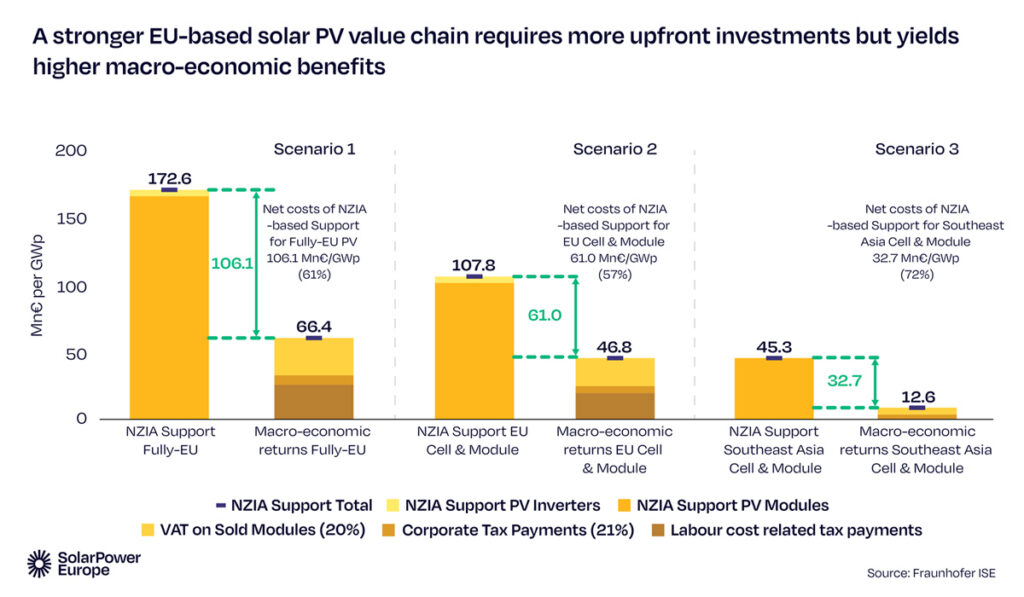

- Fully reshoring the PV value chain is more costly upfront, but delivers higher long-term macroeconomic benefits the ‘Reshoring Solar Module Manufacturing To Europe’ report models up to 2,700 jobs and €66.4 million in annual tax and social revenues per GWp/a.

Solar installations that support supply chain resilience can be competitive with imports from China with the right policy support, a new report from SolarPower Europe and Fraunhofer ISE reveals.

Walburga Hemetsberger, CEO at SolarPower Europe (she/her) said: “This new report underlines that, with the right policies, Europe can competitively deliver 30 GW of solar manufacturing by 2030, creating thousands of local jobs, and building a resilient, innovative solar supply chain that keeps economic value here at home. To meet 2030 goal, the EU and Member States must act swiftly. Without interventions, Europe risks losing remaining industrial and technological capabilities in solar.”

The ‘Reshoring Solar Module Manufacturing to Europe’ report offers a cost gap analysis and policy impact simulation, which finds that producing a solar module in Europe with EU-made solar cells costs around 10.3 €ct/Wp more than producing the same module in China.

The gap stems from higher costs in equipment (+40%), building and facility (+110%), labour (+280%), and material costs (+50%). As a result, such utility solar installations cost about 60.8 €ct/Wp compared to 50.0 €ct/Wp for a Chinese system, translating into a Levelised Cost of Electricity (LCOE) that is 14.5% higher for European-made modules. This gives a hopeful indication that already, EU-made products fall within the 15% limit of additional costs under Net-Zero Industry Act auction rules.

However, the report notes a significant cost difference (2.2 to 5.8 €ct/Wp) between NZIA compliant EU-made and NZIA compliant non-EU-made modules. The Net-Zero Industry Act’s resilience criteria can therefore diversify module supply chains and boost imports from elsewhere in the world, but without more policy measures, reshoring EU production may not be achieved.

Crucially, the report reveals that the cost gap between European made and Chinese imported solar can be further reduced to below 10% with the right mix of policies, such as combining CAPEX and OPEX schemes, both for solar manufacturers and project developers, with output-based support (e.g. successful models have existed in the US (IRA) and India (PLI schemes), and assuming solar factories reaching 3-5 GW capacity.

The report notes that industry support needs range from €1.4 – €5.2 billion annually to reach the 30 GW target for European solar manufacturing for 2030, with up to 39% of costs being recovered through macroeconomic benefits (up to 2,700 jobs and €66.4 million in annual tax and social revenues per GWp/a).

The report recommends:

- Establishing an EU-level output-based support scheme for solar manufacturing, combining grants, loans, and de-risking instruments to cover both CAPEX and OPEX.

- Implementing NZIA policy schemes across Member States, including “Made-in-EU” bonus points in rooftop support and public procurement programmes.

- “Reshoring Solar Module Manufacturing to Europe” | Read the report