Coal Phase-Out: First Global Survey of Companies and Political Entities Exiting Coal

CoalSwarm’s Global Coal Plant Tracker (GCPT) has completed the first global survey of coal phase-out plans by coal plant owners and political entities. The results show large numbers of companies and political entities exiting coal.

Of the 1,675 companies that have owned coal-fired power plants or pursued development of coal-fired power capacity since 2010, over a quarter (448 companies) have exited the coal power business entirely, with no current ownership and no further development plans.

Plans for developing additional capacity have declined even further. Nearly 70% (1,141) of the companies currently have no active plans for new power capacity, either in the pre-construction or the construction stage.

In additional to CoalSwarm’s survey of coal plant owners, a survey of political entities carried out by CoalSwarm and Greenpeace has identified 5 countries, provinces, states, and cities that have already phased out coal power, and another 18 planning a coal power phase-out by 2030 or sooner.

Reasons for shift

The findings of the ownership and political entity surveys coincide with other research reporting a shift away from investments in coal. This includes a survey by the UN Environmental Program showing overall coal- and gas-fired generation investments globally falling to less than half of non-hydro renewable investments.

Globally, the International Energy Agency’s World Energy Investment 2017 report found investments in coal power down by 20% and poised to decline further, with money flowing increasingly toward lower-cost solar, wind, and natural gas. A study by industry tracker Prequin found that investment in coal mining and coal power by private funds in North America “has completely dried up.”

According to a recent Institute for Energy Economics and Financial Analysis (IEEFA) report, the ability of renewables to outbid coal caused underperforming utilities to incur US$185 billion in lost revenues from 2007 to 2016.

For governments, coal phase-out plans have come in response to concerns over misallocation of resources in the wake of coal power overcapacity and falling utilization rates; public outcries over high levels of air pollution, especially in major Chinese and Indian cities; and growing pressure across civil society for decisive action on climate change.

A continued drop in coal power development

As of July 2017 the Global Coal Plant Tracker showed 548 gigawatts (GW) of coal power capacity in pre-construction planning and 264 GW under construction, a decline of 41% and 25% respectively from the levels reported in July 2016. These declines continue the trend documented in the CoalSwarm/Greenpeace/Sierra Club report Boom and Bust 2017 which reported a 48% percent decline in overall pre-construction activity, a 62% decline in new constructions starts, and an 85% decline in new Chinese coal plant permits during calendar year 2016.

Concentrated ownership

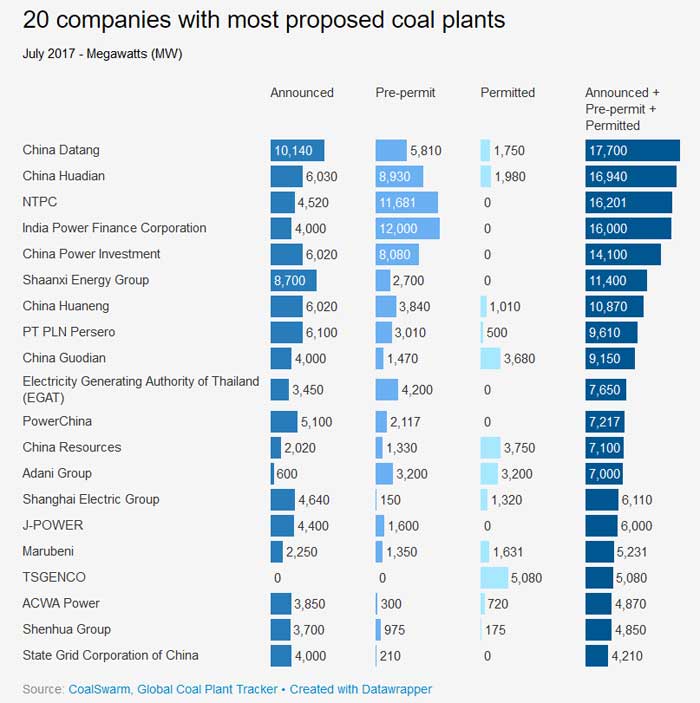

Of total coal power capacity in pre-construction development, 24% (130 GW) is concentrated among just 10 companies, and 34% (189 GW) among 20 companies, as shown in the figure below (graphic 1)

Graphic: Source: CoalSwarm, Global Coal Plant Tracker Created with Datawrapper | (“Announced” is the most preliminary stage; “pre-permit” refers to projects moving forward in securing permits or funding; and “permitted” refers to plants cleared for construction. Click here for a more detailed description of the status categories.)