Mercom Exclusive: Can Domestic Manufacturers Capture a Larger Piece of the Growing Indian Solar Market?

Solar installations in India reached 4 GW in 2016, and are expected to surpass 9 GW in 2017, an incredible pace of growth considering India installed just 883 MW in 2014.

With exponential growth in the sector, the government wants to ramp up domestic manufacturing to decrease the volume of solar module imports which, along with installations, has also increased dramatically. The challenge, like in most markets, has been cost competition from Chinese manufacturers. India also lost the World Trade Organization (WTO) ruling last year which decided that its Domestic Content Requirements (DCR) discriminated against U.S. manufacturers. With this backdrop, policy makers are looking at various options to support domestic manufacturers without violating trade agreements.

The Indian solar manufacturing sector was active long before any policy or significant market demand existed in India. The sector mainly focused on original equipment manufacturing and exporting to European countries. India had exported almost a billion dollars in modules before the National Solar Mission was established. Exports boomed in 2008 with massive growth in global demand, but the slump in 2009 (due to the global recession) slowed the sector. As manufacturing took off in China, prices dropped to record low levels. From the beginning of 2011 through the end of 2012 module prices fell from $1.80/W to $0.65/W, a 65 percent drop. State funded and subsidized Chinese manufacturers captured most of the global market at the cost of manufacturers elsewhere, including Indian manufacturers.

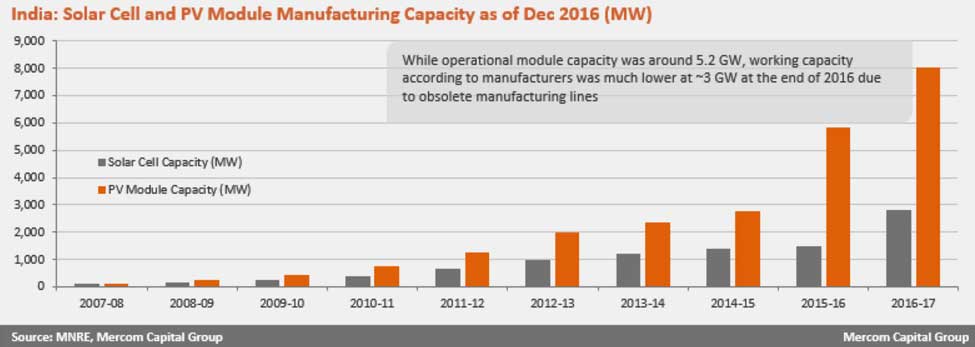

Installed capacity of domestic solar cells and modules in the country is estimated to be 2,815 MW and 8,008 MW respectively, while operational capacity of solar cells and modules is 1,448 MW and 5,246 MW respectively as of December 2016, according to Mercom’s Manufacturing Tracker.

However, manufacturers paint a different picture. Most of them are of the opinion that true working module manufacturing capacity was approximately 3 GW as of the end of 2016. This huge disparity in figures is due to old and obsolete manufacturing lines that are still being counted by manufacturers as “operating capacity”.