Five Seismic Shifts to shake Global Electricity over next 25 Years

BNEF’s forecast to 2040 sees $2.2 trillion boom in small-scale solar as consumers seize control of their power, and weaker growth in electricity demand, but prospects for the climate are bleak.

Global power generation will experience five dominant trends over the next 25 years, putting unprecedented pressure on energy companies, utilities and policy-makers, according to the New Energy Outlook 2015, published today.

NEO 2015 is Bloomberg New Energy Finance’s latest annual long-term forecast for global power, based on detailed analysis country-by-country and technology-by-technology of electricity demand, costs of generation and structural changes in the electricity system. It draws on the expertise of more than 100 analysts and researchers around the world specialising in the energy transition.

It identifies the following five major shifts that will take place between now and 2040:

- Solar, solar everywhere. The further decline in the cost of photovoltaic technology will drive a $3.7 trillion surge in investment in solar, both large-scale and small-scale.

- Power to the people. Some $2.2 trillion of this will go on rooftop and other local PV systems, handing consumers and businesses the ability to generate their own electricity, to store it using batteries and – in parts of the developing world – to access power for the first time.

- Demand undershoots. The march of energy-efficient technologies in areas such as lighting and air conditioning will help to limit growth in global power demand to 1.8% per year, down from 3% per year in 1990-2012. In OECD countries, power demand will be lower in 2040 than in 2014.

- Gas flares only briefly. Natural gas will not be the “transition fuel” to wean the world off coal. North American shale will change the gas market, but coal-to-gas switching will be mainly a US story. Many developing nations will opt for a twin-track of coal and renewables.

- Climate peril. Despite investment of $8 trillion in renewables, there will be enough legacy fossil-fuel plants and enough investment in new coal-fired capacity in developing countries to ensure global CO2 emissions rise all the way to 2029, and will still be 13% above 2014 levels in 2040.

Michael Liebreich, chairman of the advisory board at Bloomberg New Energy Finance, commented: “NEO 2015 draws together all of BNEF’s best data and information on energy costs, policy, technology and finance. It shows that we will see tremendous progress towards a decarbonised power system. However, it also shows that despite this, coal will continue to play a big part in world power, with emissions continuing to rise for another decade and a half, unless further radical policy action is taken.”

Jon Moore, chief executive of Bloomberg New Energy Finance, commented: “Last year’s forecast from BNEF identified the big share that renewables would have in power investment – that raised eyebrows at the time, but other energy forecasters have since piped a similar tune. This year’s report pushes our thinking further, with updated analysis on the slowing levels of demand we are already seeing, and on the proliferation of small PV systems.”

The small-scale solar boom will see worldwide capacity of rooftop, building-integrated and local PV soar from 104GW in 2014 to nearly 1.8TW in 2040, a 17-fold increase. This will be made possible by a 47% crash in the cost of solar projects per megawatt, as conversion efficiencies improve and the industry moves to new materials and more streamlined production methods.

Jenny Chase, chief solar analyst at Bloomberg New Energy Finance, said: “Up to now, small-scale solar investment has been dominated by wealthy countries such as Germany, the US and Japan. By 2040, developing economies will have spent $1 trillion on small PV systems, in many cases bringing electricity for the first time to remote villages.”

The BNEF analysis opens up the prospect of a clear move from a utility-scale, centralised system to one that is increasingly distributed and focused on the consumer, with household and business decisions on solar PV and storage driving many of the changes in the power system.

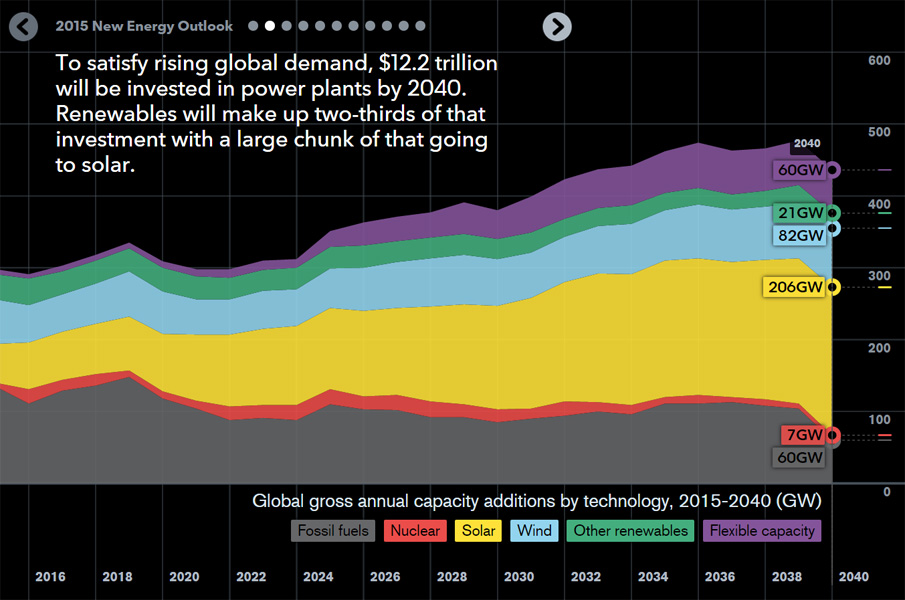

NEO 2015 finds that some $12.2 trillion will be invested in global power generation between 2015 and 2040, with only 22% of that taking place in OECD countries against 78% in the power-hungry emerging markets. Renewables will account for two thirds of that total over the next 25 years, with the old staples of coal, gas and nuclear generation attracting respectively $1.6 trillion, $1.2 trillion and $1.3 trillion.

BNEF’s forecast sees onshore wind reaching 1.8TW globally by 2040, up five-fold, utility-scale PV 1.9TW, up 24-fold, offshore wind 198GW, up 25-fold, and “flexible capacity” (ways of balancing variable renewable sources on the grid, including batteries, demand response and fast ramp-up gas generation) reaching 858GW, up 17-fold. Nevertheless, even in 2040, fossil fuels will still account for 44% of world generation (down from 67% in 2014).

The result is that, with global electricity generation rising by 56% between 2014 and 2040 as economies develop and populations grow, global power sector emissions will increase from 13.1 gigatonnes to a peak of 15.3Gt in 2029. Greater burning of coal by developing countries will more than offset the substitution of coal-firing by gas and renewables in developed economies. World emissions will then fall back, but only to 14.8Gt in 2040, still 13% above 2014 levels.

Seb Henbest, head of Europe, Middle East and Africa for Bloomberg New Energy Finance and lead author of NEO 2015, said: “The CO2 content of the atmosphere is on course to exceed 450 parts per million by 2035 even if emissions stay constant, so the trend we show of rising emissions to 2029 makes it very unlikely that the world will be able to limit temperature increases to less than two degrees Centigrade.

“The message for international negotiators preparing for the Paris climate change conference in December is that current policy settings – even combined with the vast strides renewables are making on competitiveness – will not be enough. Further policy action on emissions will be needed.”

An executive summary of NEO 2015 is available for download here. Hashtag #NEO2015