Solar PV Energy could provide 12% of European electricity demand by 2030

In the study Solar PV could be similar to the shale gas disruption for the utility industry

- Roland Berger brings recommendations for this market which has developed from a niche market segment into a high growth market

- By enabling energy consumers to produce energy, solar PV will change the energy landscape in a multidirectional system

- It poses a major threat for the current business model of utilities, but at the same time solar PV creates new business opportunities that fit well with the competences of the utilities

- Utilities should prepare to fully capture these opportunities in the future and maintain their position in the energy landscape

Solar PV has become a high growth market globally. The increase in 2014 in solar PV capacity of 39 GW is close to the nuclear power capacity of Japan and total global capacity now stands at 177 GW. Solar PV is installed on rooftops of houses and commercial building and at a utility-scale on landscapes. In Europe, traditional utilities are absent in this market segment. “Utilities own less than 1% of all solar PV capacity. Project developers, investors, households and commercial companies have started to compete with the utilities in power generation,” according to Eric Confais, partner in the Paris office of Roland Berger

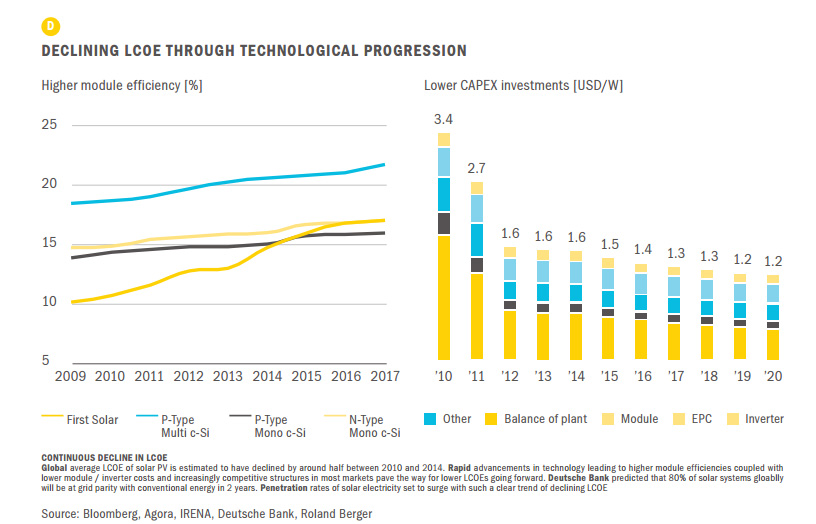

In Europe, more and more households and commercial players are expected to make the decision to invest in solar PV and install it on their rooftop. An investment in solar PV will only become more attractive over time, as system costs will continue to decline. In Germany, the price of solar PV is already 17 cents/kWh cheaper than the retail electricity price. New technologies, like battery storage and home automation systems will raise the amount of solar PV electricity that will be used by the owner himself, preventing the excess generated electricity being sold at lower prices on the grid. Improved access to financing and simple installation services offers will make it even simpler to buy a solar PV system.

As the prices of solar PV systems have dropped faster than most energy institutes have expected, the adoption of solar PV will consequently be higher than expected. “The impact is large,” says Emmanuel Fages, principal in the Paris office of Roland Berger. “In our view, solar PV could be responsible for 9-12 % of total electricity production in Europe by 2030, largely exceeding expectations of IEA, the World Energy Council and even Greenpeace.”

No central coordination in the roll-out of solar PV is present. The decision for a solar PV system is made by households that optimize their energy bill and not by utilities optimizing their production portfolio. This can have drastic repercussions on the energy system. In Germany, Greece and Italy, solar PV capacity will already exceed baseload demand by 2025. It could even exceed 50% of peakload demand, making more export and storage necessary to deal with the market situation. Eric Confais adds: “The magnitude of the solar PV impact could compare to the shale gas revolution on the energy industry. It will drastically change the energy landscape for utilities. Utilities will have to deal with increased fluctuations of the energy system, loss of generation volumes and lower prices, and even new players may enter the scene.”

Roland Berger has developed recommendations for utility companies and grid operators to deal with the higher share of solar PV that both threatens their business and creates new business opportunities. Utilities will have to prepare for lower demand for their power, especially in the higher-margin residential market segment. They should reduce the scale of the generation assets and make them more flexible to respond to demand and supply swings. With more intermittency, security of supply becomes more important as well and utilities will have to develop new models to price access to power capacity. Related to intermittency, utilities will have to shift their role from providing energy, to one of matching power demand and supply, thereby increasing their presence in trading. Here, utilities can exploit their long-established access to their customers.

Also, grid companies will have to adjust the size and shape of their grids according to the changes in the power flows with more decentral generation. Grid companies can strengthen their role in maintaining balance in their system and coordinating the market and should fully exploit the opportunities of a smart grid. Eric Confais concludes: “The energy landscape becomes more interesting. Utilities that position themselves right, can seize new business opportunities of the future. And this future is closer by than most of us have thought.”