Emerging markets catching up fast to Germany, UK, France, China as top markets for renewable energy investments

India, South Africa, Brazil, Indonesia emerge as high-need hotspots for renewable energy investments – G20 needs to double investment in renewable energy to meet Paris climate goals – Policies supporting solar and wind investments start to pay off – Allianz Climate and Energy Monitor 2017 assesses low-carbon investment climate in G20 countries.

Most G20 states improved conditions for investments in low-carbon energy over the past year, with several emerging market countries rapidly catching up to the leaders. The rapid development of the renewable energy sector is a crucial success factor for meeting the Paris climate goals. The G20 countries need to roughly double their annual investments in renewable energy to align their power infra-structure with the well below 2°C pathway, fixed at the Paris COP 21 in 2015.

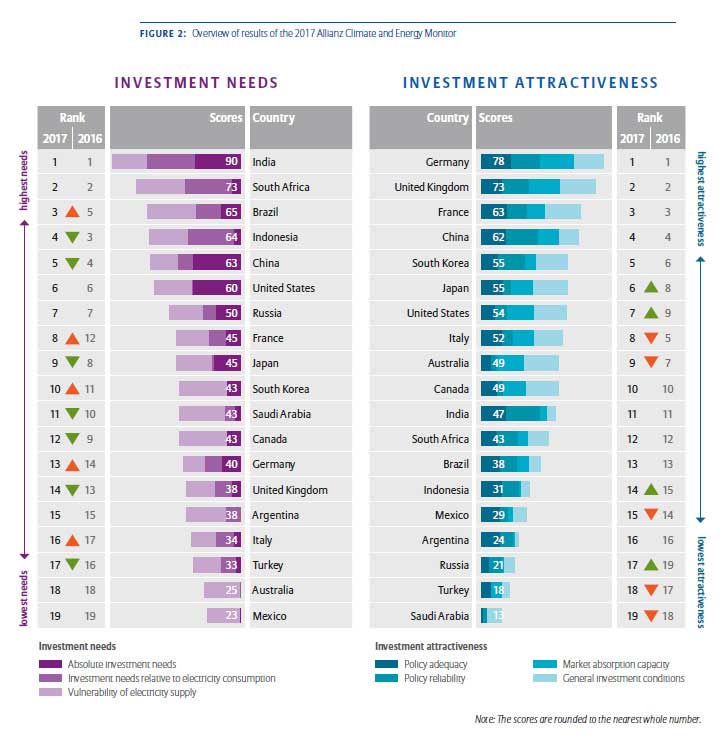

The Allianz Climate and Energy Monitor 2017 examined for the second time the needs and investment climate for all G20 countries regarding renewable energies. Germany, UK and France maintain the top three positions in the 2017 edition. They combine a largely supportive policy environment for renewable energy with a mature market and adequate general investment environment.

China holds its place in this best-performers club, maintaining rank four. With roaring renewable energy markets and a consistent policy push, China installed more solar photo-voltaic than the rest of the G20 combined in 2016. India, South Africa, Brazil and Indonesia emerge as high-need hotspots owing to increasing demand for energy, sheer size and vulnerability of the existing power system to a changing climate.

“Emerging economies are increasingly taking on a leadership role and are credibly enhancing their renewable energy financing frameworks”, says Simone Ruiz-Vergote, Managing Director at Allianz Climate Solutions. “China, India and South Africa are keenly interested in improving their attractiveness for investors in renewable energy, and they clearly managed to do so in 2016. Their prospects are good if policy support and market capacities are maintained.”

Renewables are now attracting the bulk of new power investments of the G20 growing by approximately 25% annually over the last five years. Continuously falling technology costs have supported this strong increase. In some countries renewables passed a tipping point, reaching cost-competitiveness with conventional energy sources. “Even with falling prices, a supportive policy environment for future growth of renewables is needed to provide reliable legislation for investors”, says Jan Burck from Germanwatch, co-author of the report.

The absolute investing needs in the G20 stand at about USD 700 billion per year between 2014 and 2035. For comparison: In 2015, combined investments in all power generation, including fossil fuels, stood at USD 420 billion globally. After higher initial investments in renewable energy technologies like wind and photovoltaics, the low-carbon transition can be achieved at neutral cost in mid-term.

“With the first hurdle taken in cost competitiveness, governments now need to adjust their power systems and market design to cope with an increasing share of weather-dependent renewables”, adds Prof. Dr. Niklas Höhne, founding partner of the NewClimate Institute and co-author of the Monitor.

Insurance companies can make a considerable contribution here, as well-capitalized investors with a long-term investment horizon and necessary risk management expertise. Infrastructure investments are well suited for insurers’ long-term commitments to their life insurance clients. In 2016, as a leading investor in renewable energy, Allianz placed further capital in new debt and equity investments, bringing the total to EUR 4.6 billion, Allianz plans to further increase its green investments in mid-term.

“Reliable and stable regulation enables access to larger pools of capital at lower cost. Hence, an integrated approach can help reduce the costs associated with the shift to a low-carbon economy,” confirms Axel Zehren, Chief Financial Officer at Allianz Investment Management.